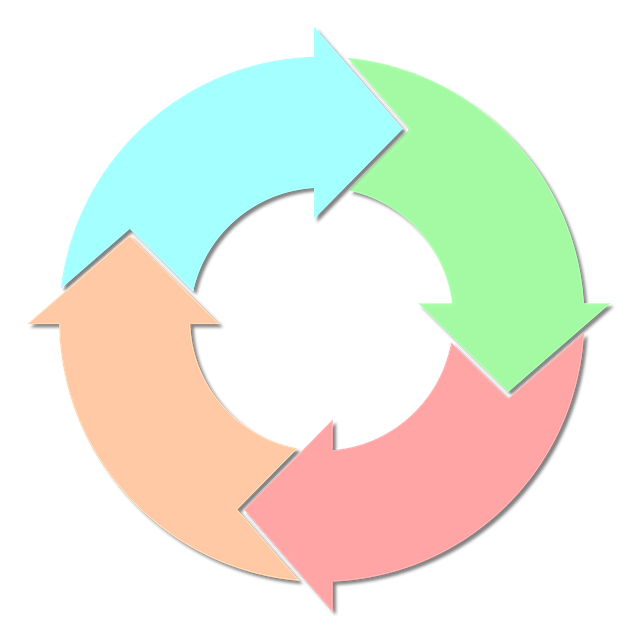

The 4 Steps of the Accounting Cycle

Accounting is essential to running a successful business. If you don’t know how much money your business spends, as well as how much money it generates in sales revenue, you’ll struggle to create a profitable business. While there are different ways to approach accounting, one of the popular methods involves the four-step accounting cycle. In just four simple steps, you can keep track of your business’s financial information.

Accounting is essential to running a successful business. If you don’t know how much money your business spends, as well as how much money it generates in sales revenue, you’ll struggle to create a profitable business. While there are different ways to approach accounting, one of the popular methods involves the four-step accounting cycle. In just four simple steps, you can keep track of your business’s financial information.

#1) Analyze Transactions

The first step of the accounting cycle is to analyze transactions. Transactions may consist of receipts and invoices. Receipts, of course, denote an expense, whereas invoices denote revenue generated. To begin with the accounting cycle, you must identify all of your business’s transactions for the given financial period.

#2) Record Transactions

After analyzing your business’s transactions, you’ll need to record them in the form of journal entries. Journal entries are a form of structured data about transactions. They typically include the date of a transaction, the dollar amount of a transaction, the account number associated with the transaction and a brief description. If you use Quickbooks, you can create journal entries for your business’s transactions using the accounting software.

#3) Add Journal Entries to General Ledger

The third step of the accounting cycle is to add the newly created journal entries to your business’s general ledger. The general ledger is a document that contains journal entries for transactions. Also known as the nominal ledger, it serves as the central hub for accounting processes. You can review your business’s general ledger to gain a better understanding of its financial health. Once you’ve identified your business’s transactions and recorded them in the form of journal entries, you should add those journal entries to your business’s general ledger.

#4) Run an Unadjusted Trial Balance Report

The fourth and final step of the accounting cycle is to run an unadjusted trial balance report. What is an unadjusted trial balance report exactly? It’s a summary of all the balances in your business’s general ledger. With an unadjusted trial balance report, you’ll see an overview of your business’s transactions displayed neatly in a single report.

The accounting cycle may seem confusing, but it’s actually rather simple. It consists of four basic steps: analyze transactions, record transactions, add journal entries to the general ledger and run an unadjusted trial balance report.

Have anything else that you’d like to add? Let us know in the comments section below!

What Is Liquidity in Business Accounting?

Have you come across the term “liquidity” when researching accounting activities? If so, you might be wondering what it means. No matter what type of business you operate, it probably has at least some liquidity. All businesses, including business-to-consumer (B2C) and business-to-business (B2B), have liquidity. With that, some have greater liquidity than others. So, what is liquidity, and how does it related to your business’s activities?

Have you come across the term “liquidity” when researching accounting activities? If so, you might be wondering what it means. No matter what type of business you operate, it probably has at least some liquidity. All businesses, including business-to-consumer (B2C) and business-to-business (B2B), have liquidity. With that, some have greater liquidity than others. So, what is liquidity, and how does it related to your business’s activities?

Overview of Liquidity

Liquidity is a measurement of how fast your business can convert its assets into cash. Whether you realize it or not, your business probably has assets that can be converted into cash. Examples of common assets owned by businesses include stocks, real estate, inventory, equipment and patents. Not all assets can be converted into cash immediately, though. You’ll typically need to sell them to generate cash. The time it takes to convert assets into cash is described as liquidity.

The Importance of Liquidity

Liquidity is important because it can help your business cover liabilities. Your business will inevitably incur debt when executing its respective operations. According to Fundera, in fact, seven in 10 small businesses have outstanding debt that haven’t paid back. Allowing debt to go unchecked, of course, can cut into your business’s profit margins. Lenders and vendors often charge interest on outstanding debt. The longer a debt goes unpaid, the more interest you’ll have to pay on it. If your business has excellent liquidity, you can use the cash generated from the sale of assets to pay off some or all of your business’s debt.

How to Improve Your Business’s Liquidity

Even if your business has poor liquidity, there are steps you can take to improve it. Reducing overhead, for example, will naturally have a positive impact on your business’s liquidity. Overhead consists of ongoing expenses that aren’t directly related to your business’s money-making activities. While you can’t always eliminate all overhead expenses, you can often reduce them. Canceling unnecessary services and changing utility companies can reduce your business’s overhead and, therefore, improve its liquidity.

If your business uses invoices, you can improve its liquidity by collecting from delinquent customers or clients. Customers and clients don’t always pay invoices on time. They may allow invoices to go unpaid longer after the due date. By collecting payments from these customers or clients, your business’s liquidity will increase.

Have anything else that you’d like to add? Let us know in the comments section below!

Positive vs Negative Cash Flow: What’s the Difference?

Cash flow offers an accurate representation of your business’s profitability. Regardless of what products or services your business sells, you can use this metric to determine whether your business is succeeding or failing at generating profits. Cash flow, however, can have a positive or negative value. For effective cash flow management that helps your business succeed, you must understand the differences between positive and negative cash flow.

Cash flow offers an accurate representation of your business’s profitability. Regardless of what products or services your business sells, you can use this metric to determine whether your business is succeeding or failing at generating profits. Cash flow, however, can have a positive or negative value. For effective cash flow management that helps your business succeed, you must understand the differences between positive and negative cash flow.

What Is Positive Cash Flow?

Positive cash flow means your business received more cash — or other assets for than matters — during a given period than what it spent or incurred during the same period. All businesses have incoming and outgoing cash. Incoming cash refers to payments from customers or clients as well as money generated from other business-related activities, such as investing. Assuming your business’s incoming cash is greater than its outgoing cash, the value of its cash flow will be positive.

What Is Negative Cash Flow?

Negative cash flow, on the other hand, means your business spent or incurred more money during a given period than what it generated or otherwise received. A negative cash flow is concerning because it indicates your business is spending more money than it’s making. If your business has some cash reserves, it may be able to weather a short period of negative cash flow. Eventually, though, it will need to change its practices to achieve positive cash flow. Allowing negative cash flow to go unchecked for an extended period will quickly drain your business’s finances. Negative cash flow, in fact, is a common reason why small businesses fail.

Tips to Improve Your Business’s Cash Flow

Even if your business’s cash flow is negative, there are ways to turn it around. For example, you may be able to improve your business’s cash flow by switching utility companies. If your business operates out of an office or building, shop around for different utility providers. With a little luck, you may find a new utility provider that offers a lower price than your business’s current provider.

Another way to improve your business’s cash flow is to lease equipment rather than buying it. When you lease equipment, you’ll essentially pay to use it. Therefore, it’s almost always cheaper in the short term to lease rather than buy equipment. The only downside is that you won’t own the equipment when you lease it. You can also send invoices to customers and clients more quickly. The sooner a customer or client pays, the better.

Have anything else that you’d like to add? Let us know in the comments section below!

How Does Accounts Receivable Financing Work?

A bank loan isn’t the only way you can finance your business’s operations. There are alternative financing options available, one of which is accounts receivable financing. If your business uses invoices to collect payments from its customers or clients, you can use accounts receivable financing. With that said, you might be wondering how this alternative financing method works exactly.

A bank loan isn’t the only way you can finance your business’s operations. There are alternative financing options available, one of which is accounts receivable financing. If your business uses invoices to collect payments from its customers or clients, you can use accounts receivable financing. With that said, you might be wondering how this alternative financing method works exactly.

The Basics of Accounts Receivable Financing

Accounts receivable financing involves tapping into your business’s unpaid invoices for financing. There are private financing companies that specialize in accounts receivable financing. They will either buy your business’s unpaid invoices — typically at a slightly lower rate than their face value — or they will loan you money using your business’s unpaid invoices as collateral.

Under the former option, you’ll obtain money by selling unpaid invoices to a private financing company. The financing company will essentially buy your business’s unpaid invoices. Under the latter option, you’ll obtain money in the form of a loan by using your business’s unpaid invoices as collateral. You’ll still have to pay back the loan, but you’ll get immediate cash that you can use to finance your business’s operations. There are the two basic methods used for accounts receivable financing.

Advantages of Accounts Receivable Financing

Many businesses struggle to collect payments from their customers or clients. With accounts receivable financing, you don’t have to waste time or resources trying to collect payments. You can simply sell the unpaid invoices to a private financing company.

Accounts receivable financing is also faster than traditional financing methods, such as bank loans. It can take well over a month for a bank to approve your business for a traditional loan. In comparison, private financing companies may approve your application for accounts receivable financing in just a few weeks. If your business is in dire need of immediate cash, accounts receivable financing can be an attractive choice for this reason.

Disadvantages of Accounts Receivable Financing

Accounts receivable financing, of course, is only an option if your business uses invoices. If customers or clients pay upfront, you won’t be able to use this alternative financing method.

If you intend to sell your business’s unpaid invoices, it’s important to note that you won’t get the full value for them. Private financing companies make money by buying unpaid invoices at a lower value.

Have anything else that you’d like to add? Let us know in the comments section below!

How to Record Equipment Purchases in Quickbooks

If you’ve recently purchased equipment for your business, you might be wondering how to record it in Quickbooks. Assuming your business needs the equipment to perform its revenue-generating operations, you can write it off on your taxes. There’s no option specifically for “equipment” in Quickbooks, however, leaving many business owners to believe that it’s not possible to record such transactions. While Quickbooks doesn’t have an option for equipment, you can still record the transaction.

If you’ve recently purchased equipment for your business, you might be wondering how to record it in Quickbooks. Assuming your business needs the equipment to perform its revenue-generating operations, you can write it off on your taxes. There’s no option specifically for “equipment” in Quickbooks, however, leaving many business owners to believe that it’s not possible to record such transactions. While Quickbooks doesn’t have an option for equipment, you can still record the transaction.

Equipment Is a Fixed Asset

In Quickbooks, equipment is typically recorded as a fixed asset. Fixed assets, of course, are long-term resources that you don’t intend to consume or sell within the fiscal period in which you purchased it. As a result, most types of equipment are considered fixed assets. You may keep a piece of equipment for several years, all while using it to facilitate your business’s money-making activities. Because equipment is typically a fixed asset, that’s how you’ll need to record it in Quickbooks.

Steps to Recording Equipment Purchases in Quickbooks

You can record equipment purchases in Quickbooks by labeling them as fixed assets. After logging in to your Quickbooks account, click the gear icon on the home screen, followed by “Chart of Accounts” below your company’s name. Next, click “New” in the upper-right corner. You can then choose the option for “Fixed Asset” under the menu for account type.

Assuming you’ve followed these steps, you should now be able to enter the details about the equipment purchase, including the type and original cost. You’ll also be able to create a unique name for the fixed asseet account.

Keep in mind that Quickbooks supports depreciation tracking of fixed assets. If you click the box labeled “Track depreciation of this asset,” Quickbooks will add a subaccount for depreciation. Once created, you can track the equipment’s depreciation over time. Of course, depreciation tracking is optional, meaning you aren’t required to use it. Nonetheless, many business owners and accountants use this feature to track how much their equipment has depreciated in value.

After completing all the required fields, as well as setting up depreciation tracking, you can complete the process by clicking “Save and close.” Congratulations, you’ve just recorded the equipment purchase. You’ll now be able to view the transaction by looking at your business’s fixed asset purchases in Quickbooks.

Have anything else that you’d like to add? Let us know in the comments section below!

5 Tips on How to Go Paperless in Your Office

How much paper do you typically use in your office? Research shows that office workers in the United States use an average of 10,000 sheets of paper annually. Some workers, of course, use far more paper. If your office is cluttered with paper, though, you should consider the following tips on how to go paperless. By making just a few small changes to your workspace and daily work activities, you can reduce or potentially even eliminate the need for paper.

How much paper do you typically use in your office? Research shows that office workers in the United States use an average of 10,000 sheets of paper annually. Some workers, of course, use far more paper. If your office is cluttered with paper, though, you should consider the following tips on how to go paperless. By making just a few small changes to your workspace and daily work activities, you can reduce or potentially even eliminate the need for paper.

#1) Take Notes on Your Smartphone

Many office workers create notes on printer paper or sticky notes. A better idea, however, is to use your smartphone for note-taking. Whether you own an Android- or Apple-powered smartphone, you can download a note-taking app. Note-taking apps live up to their namesake by allowing you to take notes on your smartphone.

#2) Use a Whiteboard

In addition to your smartphone, you can use a whiteboard to create notes and other temporary messages. A whiteboard, of course, is a dry-erase board that supports the creation of temporary messages. After writing a message on a whiteboard, you can erase it with a dry cloth.

#3) Scan Documents

To truly go paperless in your office, you’ll need to invest in a scanner. Using a scanner, you can create digital copies of paper documents. Rather than keeping large file cabinets full of paper documents, you can convert those documents into digital files. Known as digitizing, it’s become increasingly popular among office-based businesses.

#4) Use Credit or Debit Cards for Business Purchases

When purchasing products or services associated with your business’s operates, use either a credit or debit card. Why is this important? If you pay for a product or service using cash, you’ll only have a paper receipt. Using a credit or debit card, on the other hand, creates a digital trail. The vendor may still give you a receipt, but you’ll also be able to access your financial records digitally to view the transaction information.

#5) Recycle

You may not be able to eliminate all the paper in your office. Nonetheless, following these tips can help you go paperless by significantly reducing the amount of paper your office uses. And you can always recycle any remaining paper in your office — assuming you don’t need it. Even if it has ink on it, most types of printer paper is recyclable.

Have anything else that you’d like to share? Let us know in the comments section below!

5 Accounting Tips for Independent Contractors

Do you work as an independent contractor? You aren’t alone. According to the U.S. Bureau of Labor Statistics (BLS), over 16 million Americans are classified as independent contractors. They are technically still business owners; they just don’t own or work for an incorporated business, such as a limited liability company (LLC) or a corporation. While working as an independent contractor has its perks, you’ll need to keep detailed and transparent records of your business’s financial transactions. Here are five essential accounting tips for independent contractors.

Do you work as an independent contractor? You aren’t alone. According to the U.S. Bureau of Labor Statistics (BLS), over 16 million Americans are classified as independent contractors. They are technically still business owners; they just don’t own or work for an incorporated business, such as a limited liability company (LLC) or a corporation. While working as an independent contractor has its perks, you’ll need to keep detailed and transparent records of your business’s financial transactions. Here are five essential accounting tips for independent contractors.

#1) Separate Personal and Business Expenses

The golden rule of accounting is to separate personal and business expenses — a rule that applies to all business entities, including independent contractors. If you only have a single checking account, which you use for personal expenses, open a second checking account so that you can use it for your business’s expenses. With an account for your personal expenses and another account for your business’s expenses, you won’t accidentally or otherwise mix these two expenses.

#2) Use Digital Payments Methods When Possible

When given the option between paying for a business-related expense with cash or a digital method, choose the latter. If you use cash to buy a product or service needed to execute your business’s operations, you won’t have a digital record of it. At best, you’ll have a paper receipt, which are undoubtedly easy to lose. Paying with a credit card or debit card, on the other hand, will create a digital record of the transaction.

#3) Consider Getting an EIN

Independent contractors are distinguished from other business entities because they can operate under their respective Social Security number. With that said, you can still use an Employer Identification Number (EIN). Using an EIN is beneficial as an independent contractor because it protects your Social Security number from unnecessary exposure. Rather than providing your Social Security number to a business, you can give the business your EIN.

#4) Make Quarterly Tax Payments

As an independent contractor, you’ll be responsible for making quarterly tax payments to the Internal Revenue Service (IRS). This involves estimating your business’s income for the following year, after which you can calculate your projected taxes while breaking them into four equal payments. Failure to make quarterly tax payments will result in a penalty.

#5) Use Quickbooks Self-Employed

Quickbooks offers accounting software that’s designed specifically for independent contractors. Known as Quickbooks Self-Employed, it’s a smart investment that can help you keep better financial records. Among other things, Quickbooks Self-Employed will separate your personal and business expenses, ensure maximum deductions and even allow you to prepare estimated quarterly tax payments.

Have anything else that you’d like to share? Let us know in the comments section below!

Beware: 5 Things That Can Hurt Your Business’s Cash Flow

What does your business’s cash flow typically look like? Defined as the net amount of available cash your business has at the end of an accounting period, it’s an important metric that reflects your business’s financial health. While your business’s cash flow will likely fluctuate from month to month, you should beware of the five following things that can hurt its cash flow.

What does your business’s cash flow typically look like? Defined as the net amount of available cash your business has at the end of an accounting period, it’s an important metric that reflects your business’s financial health. While your business’s cash flow will likely fluctuate from month to month, you should beware of the five following things that can hurt its cash flow.

#1) Unpaid Customer Invoices

Not all of your business’s customers will pay their invoices immediately upon reception. Some customers may wait a few days to pay their invoices, whereas others may wait or weeks or even months. The longer it takes a customer to pay his or her invoice, though, the greater the risk of it hurting your business’s cash flow.

#2) Excess Inventory

If your business sells physical products — as opposed to virtual products or services — you should beware of excess inventory. Like unpaid customer invoices, excess inventory can hurt your business’s cash flow. You’ll have to spend money to restock your business’s inventory, resulting in less available cash on hand. Assuming you don’t sell the newly stocked inventory in the same account period during which you purchased it, it will bring down your business’s cash flow.

#3) Interest on Debt

Something else that can hurt your business’s cash flow is interest on debt. Although there are exceptions, most lenders require borrowers to pay interest on debt. If you take out a loan to cover some of your business’s short- or long-term expenses, for example, you’ll have to pay interest on it. Interest payments such as this will lower your business’s cash flow.

#4) High Overhead

You’ll probably encounter overhead expenses when running a business. Overhead, of course, includes all expenses that aren’t directly related to your business’s operations. Common examples include utilities, rent, insurance, office supplies and payroll.

#5) Lack of Sales

Of course, a lack of sales can hurt your business’s cash flow as well. If your business sells few or no products or services during a given accounting period, its cash flow will suffer during that same account period. All businesses experience ups and downs in regard to sales — it’s just something that comes with the territory of operating a commercial business. If your business’s sales remain stagnent for a prolonged length of time, though, it may hurt your business’s cash flow.

Have anything else that you’d like to add? Let us know in the comments section below!

A Beginner’s Guide to the First In, First Out (FIFO) Accounting Method

Have you heard of the first in, first out (FIFO) accounting method? It’s used by countless businesses to track their respective inventory. With the FIFO method, businesses assume their oldest products have been sold first. Businesses can then include these assets in their respective cost of goods sold (COGS). All other assets will be valued according to this information. While the FIFO accounting method may sound complex, however, it works in a relatively simple way.

Have you heard of the first in, first out (FIFO) accounting method? It’s used by countless businesses to track their respective inventory. With the FIFO method, businesses assume their oldest products have been sold first. Businesses can then include these assets in their respective cost of goods sold (COGS). All other assets will be valued according to this information. While the FIFO accounting method may sound complex, however, it works in a relatively simple way.

Overview of FIFO

FIFO is an accounting method that’s designed to help businesses assume their cash flow. Businesses, of course, must spend money to move inventory. It costs money to produce, market, sell and distribute products. Under the FIFO accounting method, a business will assume that its oldest products have been sold first. With this information in hand, the business can calculate its COGS. COGS is calculated using the FIFO accounting method by taking the cost of a business’s oldest product and multiplying it by the number of units of solds.

A business may not necessarily sell its oldest products first. It may sell newer units of a specific product before the older units. Regardless, the FIFO accounting method works on the assumption that oldest products are sold first. Any remaining and unsold units of a product are then considered new.

FIFO vs LIFO: What’s the Difference?

There’s also the last in, first out (LIFO) account method. As you may have guessed, the LIFO accounting method contrasts with the FIFO method by assuming a business’s newest products are sold first.

FIFO is an older and more common accounting method. It wasn’t until the 1970s when it picked up momentum as a way for businesses to reduce their income taxes. The Internal Revenue Service (IRS), however, has since adjusted its code to prevent businesses from monetary benefiting from the use of the LIFO accounting method.

In Conclusion

To recap, FIFO is an accounting method that involves cash flow assumptions based on the sale of a business’s oldest products first. Businesses typically don’t move all their inventory overnight. It can take months or years for a business to sell its products. Even then, it may not sell all of its products. Under the FIFO accounting method, a business will assume its oldest products are first.

Have anything else that you’d like to share? Let us know in the comments section below!

What Is a Subsidiary Account?

For healthy financial records, you’ll need to track all of your business’s accounts. There are different ways to categorize accounts, however, one of which involves the use of subsidiary accounts. Found below a control account, they contain the information that’s reported in a general ledger account. To learn more about subsidiary accounts and how they are used in accounting, keep reading.

For healthy financial records, you’ll need to track all of your business’s accounts. There are different ways to categorize accounts, however, one of which involves the use of subsidiary accounts. Found below a control account, they contain the information that’s reported in a general ledger account. To learn more about subsidiary accounts and how they are used in accounting, keep reading.

The Basics of Subsidiary Accounts

A subsidiary account is a type of financial account — income, expenses, etc. — that’s designed to categorize and track different types of transactions. They are designed to reflect the general ledger account to which they are added. For example, you may have a general ledger account for “Shipping Expenses,” to which you can add related subsidiary accounts like “bubble wrap,” “postage,” “shipping insurance,” etc.

The total amount of all the related subsidiary accounts must equal that of the general ledger account to which they are added. If the “Shipping Expenses” account is $15,000, the subsidiary accounts should add up to $15,000 as well.

Subsidiary vs Control Accounts: What’s the Difference?

Subsidiary accounts work in control with control accounts. A control account is simply a general ledger account to which one or more subsidiary accounts are added. In the aforementioned example, the control account is “Shipping”, whereas all other accounts are subsidiary accounts.

To create and use subsidiary accounts, you must determine which control account is most relevant to them. You can think of subsidiary accounts as subfolders, with control accounts being a parent folder. Therefore, the subsidiary accounts must be placed under a control account. Of course, you can’t place the same subsidiary account under two or more control accounts. Rather, each subsidiary account must be linked to more than one control account.

The Benefits of Using Subsidiary Accounts

Using subsidiary accounts can make it easier to track your business’s accounts on a more detailed level. With them, you’ll be able to break down your business’s income and expense accounts.

Subsidiary accounts also allow you to verify the total amount of your business’s control accounts. When you add subsidiary accounts to a control account, the total amounts must be equal. In other words, all of the subsidiary accounts added to a control account should add up to the same amount as the control account. If not, it indicates an accounting error, in which case you can go back to find and fix the discrepancy.

Have anything else that you’d like to add? Let us know in the comments section below!