Intuit Acquires Payroll Service Acrede

Intuit, maker of the world’s most popular and widely used business accounting software Quickbooks, recently purchased the UK-based payroll service company Acrede.

Intuit, maker of the world’s most popular and widely used business accounting software Quickbooks, recently purchased the UK-based payroll service company Acrede.

According to an article published by TechCrunch, the deal was announced in a brief magazine feature written by the CEO of Acrede. We still don’t know the financial details of the deal, but it’s safe to assume that Intuit paid a pretty penny for the company. Acrede offers cloud-based payroll services to companies and businesses of all shapes and sizes, streamlining the process of paying employees.

TechCrunch notes that Intuit actually developed its on web-based payroll service before purchasing Acrede. You might be wondering why exactly Intuit would express interest in Acrede if it already has its own web-based payroll service. Well, Acrede’s service is established throughout Europe and Asia — something that’s not found in Intuit’s new service. These markets are growing by leaps and bounds with each passing year, and it’s important for Intuit to deliver quality services to customers here.

“Acrede’s cloud-based global platform processes payroll for employees in 30 countries with scalable technology and a talented team with deep global tax and compliance expertise,” Karen Peacock, GM of employee management solutions in Intuit’s Small Business Group, said in a written statement. “We’re excited to welcome them to the Intuit team.”

There are literally dozens of different payroll services already available, so what sets Acrede apart from the rest? For starters, it’s a strictly cloud-based service, meaning it will likely deliver greater performance, efficiency and cross-compatibility when compared to others. We talk about the benefits of cloud computing in greater detail here, but it’s worth mentioning again that cloud services are optimized for efficiency and performance. Cloud-based payroll services, such as those offered by Acrede, are sure to attract businesses and companies looking for an effective payroll solution.

Unfortunately, there’s no word yet on when exactly Intuit will implement Acrede into its normal business operations. It could be next week, or it could be next year (which isn’t that far off, BTW). Regardless, you can check back with our blog here MyVao.com for all of the latest news surrounding Intuit, Quickbooks, and other business accounting topics.

Do you think this acquisition was a smart move for Intuit? Let us know in the comments section below!

Investing 101: A Simple Approach To Investing

Instead of allowing your money to sit in a checking or savings account with little to no interest rate, you should consider some more lucrative alternatives. Sure, your money is almost guaranteed to be the safest while in a government-insured checking account, but you’re essentially leaving some passive forms of revenue on the table by doing so.

Instead of allowing your money to sit in a checking or savings account with little to no interest rate, you should consider some more lucrative alternatives. Sure, your money is almost guaranteed to be the safest while in a government-insured checking account, but you’re essentially leaving some passive forms of revenue on the table by doing so.

Before we go into methods of investing, you first must understand and follow the basic principles of saving. For starters, you have to save more money than what you’re spending. If you’re buying too many luxury items and unnecessary expenses, chances are you’re not going to have any extra money to save. Work on budgeting your finances first and then you can start thinking about how to invest your money.

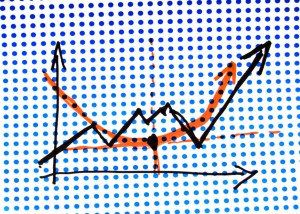

When your debt is up to date and there’s money in your savings account, it’s time to start looking for smarter investing alternatives. Unless you have experience trading stocks or commodities, I recommend staying away from these sectors as there’s a potential to lose all of your investment. Remember the golden rule of investing, though – greater risk means the potential for higher profits.

One of the safest types of investment is a government bond. These are bonds issued and backed by the federal government which promise the holder a specified amount of money and interest when cashed in on a certain date. Typically, the individual holds on to to a government bond for a given period of time (5, 10, 30+ years) before they’re able to cash it in.

If you’re willing to try an investment alternative with a slightly higher risk, you should consider placing your money into a mutual fund. Basically, these are stock purchases which are made and managed by reputable financial investors. The primary advantage of a mutual fund is the fact that your money is spread across a variety of stocks, which reduces your overall risk. When choosing a mutual fund to invest in, look at its history to see how it performed in the past. Obviously, you want to invest your money in one with a positive return and not many high or low spikes.

No matter what route you decide to take with your investment, you have to treat it as a long-term financial solution. It’s all too common for individuals to pull their money out of bonds, stocks, mutual funds or some other form of investment at the first sign of trouble. Keep an eye on your investments and watch for signs new trend shifts and patterns.

When in doubt, speak with a financial adviser to see what investment options he or she recommends. Bonds and mutual funds are two of the safest forms of investment which can still provide a nice return on your initial investment. However, there is big money to be made in trading stocks and commodities if you’re willing to do the leg work and take the risk. Only an experienced financial adviser can tell you what the risk option is for investing your money.

How To Set Up a Budgeting Plan

For most individuals, saving money is a task that’s easier said than done. Although, there is hope on the horizon for building income in your savings account. It’s not always easy and it certainly wont happen overnight, but following a few basic financial principles will put you on the right path to building a comfortable nest egg.

For most individuals, saving money is a task that’s easier said than done. Although, there is hope on the horizon for building income in your savings account. It’s not always easy and it certainly wont happen overnight, but following a few basic financial principles will put you on the right path to building a comfortable nest egg.

We’re all guilty of a little frugal and unnecessary spending from time to time. Now don’t get me wrong, there’s nothing wrong with splurging and treating yourself to something nice once in a while, but you have to get out of the habit of buying unnecessary things if you want to save money. Instead, focus on the necessities such as food, water, utilities, rent, car payment, insurance and medical treatment.

If you’re in the habit of going out to eat 2 or 3 nights a week, you probably don’t realize just how much extra money you’re spending on food. Even if it’s just a $20 or $30 meal, that’s nearly $200 a month or $2,400 a year! It’s nice to enjoy eating out once in a while, but try to limit yourself to once or twice a month. This alone will put a nice lump of extra money into your pockets.

Clothes are another necessary item that you must factor into your budget. It should go without saying to avoid high-dollar designer clothes and stick with lesser-known brands which cost a fraction of the price. Another money-saving tip I’ll give you is to do an internet search for store coupons before you go shopping. I’ve literally saved hundreds of dollars on some of my clothes shopping trips just from printing up coupons at home.

As of August, 2012, the average price for a gallon of gas in the U.S. is $3.610. While the price has dropped some since last year, it’s still enough to put a burden on just about anyone’s wallet or bank account. Because of this, you should try to avoid any unnecessary driving that’s only going to eat up your gas. Schedule a day out of the week to get all of your errands and running around town done at once.

You should also consider how well your car or vehicle handles gasoline. If you’re in a gas-guzzling SUV or jacked up truck, it might be in your best financial interest to trade it in for something more economical, such as Honda Civic or Ford Focus. Both of these vehicles are proven to stretch your gas money farther.

Once you’ve cut back on some of your unnecessary spending, you should begin to focus on putting money into your bank and leaving it there. See if your employer offers automatic bank deposits and have them deposit your paychecks directly into your account. Not seeing or having all of your money right in front of you will prevent you from spending it on things you don’t need.

These are just a few tips which will help change your financial direction to saving more and spending less. Just remember to cut back on spending money on things you don’t need and try to focus more on saving and building up your bank account.

Smart Personal Financing and Budgeting Tips

Lets face it, budgeting your personal finances can be an overwhelming task that can easily become too much for a single individual to handle. When your income and spending habits remain steady, you may not have a problem doing so. However, once you begin to accrue other debt such as credit cards, personal loans, car notes, etc, your finances can easily spiral out of control.

Lets face it, budgeting your personal finances can be an overwhelming task that can easily become too much for a single individual to handle. When your income and spending habits remain steady, you may not have a problem doing so. However, once you begin to accrue other debt such as credit cards, personal loans, car notes, etc, your finances can easily spiral out of control.

One of the largest personal finance challenges individuals face is credit card debt. If you’ve ever owned a credit card, then you’re probably aware of just how easy it is for that balance to spiral out of control. As long as you’re making the minimum payments, most credit card companies will continue to increase your spending limit. As your maximum spending limit increases, so does the total amount you’re spending on interest and other fees.

The first step in eliminating your credit card debt is to identify which card is the biggest problem and focus on paying it off first. Common sense should tell you that the card with the highest interest rate is the one eating up most of your payments. Instead of your payments going towards the balance of your credit card debt, it’s simply being used to pay the interest rate. Go through the monthly statements of any and all of your credit cards to determine which one contains the highest interest rate and focus on paying it off first.

Paying off your credit cards isn’t something that’s going to happen overnight. After all, you didn’t accumulate all of that debt in just a day’s time, so you can’t expect it go away that quickly either. With that said, you’ll soon see substantial progress if you focus on paying off one card at a time. The balance will continue to go down until you’re at that happy zero mark. Just try not to get yourself into the same boat of credit card debt you were originally in once you’ve eliminated your balance on those deadly pieces of plastic.

In addition to keeping your spending down, you may also want to think about taking up a second job. As long as you have 10+ hours of free time a week, there’s no reason why you can’t use it to increase your revenue. I know this may be difficult for parents and individuals with other responsibilities, but most people shouldn’t have a problem picking up a second job. Perhaps you could cut out that those weeknight bar trips with your buddies. Not only will this free up some of your time, but it will directly save you money as well.

Contrary to what many people believe, the job market has actually picked up this year. With the recent growth of small businesses in our country, thousands of new jobs are created each year. You should take advantage of this growth by looking for a part-time job either online or in the newspaper. Think about what type of skills you can offer a company and find someone looking for your expertise. Everyone has something they’re good at and chances are there’s a company who needs those skills.

Amazon Unveils New Payment Model For Cloud Services

Amazon is arguably one of the largest and most popular providers of cloud-based services. Amazon Web Services delivers cloud-based computing power to thousands of businesses, big and small, from all parts of the world. While the e-retailing giant has long offered different payment methods, Amazon unveiled several new options this month. To learn more about the new payment options being added to Amazon Web Services, keep reading.

Amazon is arguably one of the largest and most popular providers of cloud-based services. Amazon Web Services delivers cloud-based computing power to thousands of businesses, big and small, from all parts of the world. While the e-retailing giant has long offered different payment methods, Amazon unveiled several new options this month. To learn more about the new payment options being added to Amazon Web Services, keep reading.

Like many cloud-based service providers, Amazon has long offered discounts to customers who pre-pay for their services. If a business owner is willing to pay ahead of time, he or she can expect to pay less for Amazon Web Services. Well, it appears that Amazon is now taking this payment platform one step further with the introduction of three additional Reserved Instance options.

The new payment options are broken down into three categories: all up front (pay for the entire term upfront), partial upfront (pay a portion of the term upfront, and no upfront (pay nothing upfront but commit to pay over the course of the term).

Amazon described the new Web Service payment options in a blog post, saying the following:

All Upfront – You pay for the entire Reserved Instance term (one or three years) with one upfront payment and get the best effective hourly price when compared to On-Demand.

Partial Upfront – You pay for a portion of the Reserved Instance upfront, and then pay for the remainder over the course of the one or three year term. This option balances the RI payments between upfront and hourly.

No Upfront – You pay nothing upfront but commit to pay for the Reserved Instance over the course of the Reserved Instance term, with discounts (typically about 30%) when compared to On-Demand. This option is offered with a one year term.

So, why is Amazon changing its payment options? Given the fact that Amazon is already an established leader in the cloud-based computing service business, some people are questioning the company’s recent payment change. Simply put, cloud services is a highly competitive business, with major tech companies like Microsoft, Apple, IBM and even Google trying to knock out Amazon. The e-retailer hopes these changes will encourage users to purchase its cloud services over its competitors.

What do you think of Amazon’s new payment model for cloud services? Let us know in the comments section below!

How To Set Up and Use an Owner’s Draw

An owner’s draw is a financial account in Quickbooks that’s used to track payments made to the business owner (hence the name). Every business owner must pay him or herself sooner or later. By recording these transactions in an owner’s draw, you’ll have an easier time keeping track of your business’s finances. If you’re interested in learning more about owner’s draw and how to set them within Quickbooks, keep reading.

An owner’s draw is a financial account in Quickbooks that’s used to track payments made to the business owner (hence the name). Every business owner must pay him or herself sooner or later. By recording these transactions in an owner’s draw, you’ll have an easier time keeping track of your business’s finances. If you’re interested in learning more about owner’s draw and how to set them within Quickbooks, keep reading.

Setting Up an Owner’s Draw Account

To create an owner’s draw, log into your Quickbooks account and access Lists > Chart of Accounts. At the bottom left-hand side of the screen, you’ll see a menu with “Accounts.” Click this link followed by “New.” Next, choose Equity > Continue.

You’ll be asked several questions regarding the new account, including what you’d like to name it (optional) and a description. Assuming you have just a single owner’s draw account, an easy name to remember is “Owner’s Draw.” If you have multiple owner’s draw accounts, however, you may want to include the name of the respective owner/payee in the name field for each account. When you are finished choosing a name and description, click Save & Close to complete the setup. Sorry if you were expecting more, but that’s all it takes to set up an owner’s draw account!

Writing Checks From an Owner’s Draw Account

Making payments from an owner’s draw account is a relatively simple and straightforward process. To write a check from the owner’s draw account, choose Banking > Write Checks, at which point a new window should appear asking you for more information. Under the “Pay to the order of” section, enter the business owner’s name to whom you wish to send the check, and the dollar amount of the payment. Last but not least, assign the amount of the check to the owner’s draw account. Click Save & Close to write the check and complete the process.

Remember, the owner’s draw account should only be used when making payments to the respective business owner. Using this account for your standard payroll isn’t recommended.

Were you able to set up an owner’s draw by following the steps outlined here? Let us know in the comments section below!