What is ‘Goodwill’ in Business Accounting?

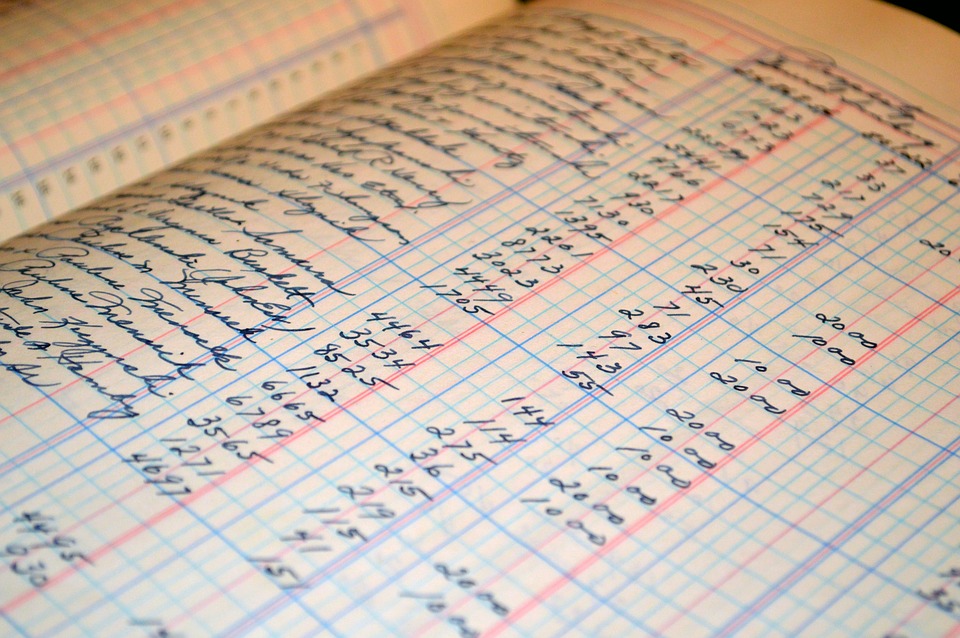

The term “goodwill” — when speaking in the context of business accounting — refers to a business’s asset that’s created and recorded when a company acquires another company. There are a few requirements for goodwill, however. The purchase price of said company, for instance, must be greater than the combination of the fair value of the tangible and intangible assets acquired, and all liabilities must be assumed when calculating this information. To learn more about goodwill and when it’s appropriate to record it in your business’s accounting books, keep reading.

The term “goodwill” — when speaking in the context of business accounting — refers to a business’s asset that’s created and recorded when a company acquires another company. There are a few requirements for goodwill, however. The purchase price of said company, for instance, must be greater than the combination of the fair value of the tangible and intangible assets acquired, and all liabilities must be assumed when calculating this information. To learn more about goodwill and when it’s appropriate to record it in your business’s accounting books, keep reading.

It’s important to note that goodwill represents the total assets, not separate assets. It doesn’t include any identifiable assets that can be separated or divided from the company entity and sold or otherwise exchanged for money or assets. Some common identifiable assets that can not be included in goodwill are a company’s name, customer/client relationships, artistic assets, patents and proprietary practices or technologies.

The total goodwill is the excess of money paid to buy the purchased business (known as purchase consideration) over the value of the assets and liabilities. On the balance sheet, goodwill is considered an intangible asset, as it cannot be seen or touched. In comparison, tangible assets can most certainly be seen or touched.

As noted in the US GAAP and IFRS, goodwill shouldn’t be amortized. Rather, the company should value goodwill on an annual basis to determine whether or not impairment is needed. Generally speaking, if the fair market value drops below what the company was purchased for, you should record an impairment to bring the value down to the fair market. On the other hand, if the company’s fair market value increases, you do not need to account for it on your statements. Some private companies may choose to amortize goodwill over the course of 10 or fewer years as an accounting alternative.

With that said, companies in the United States do not have to amortize any goodwill recorded in their books. In 2001, this requirement was dropped, making the process of acquiring companies just a little easier.

Hopefully, this gives you a better understanding of goodwill in business accounting and why it’s used. To recap, goodwill is an intangible asset that’s created and recorded when a company buys another company. It’s reported on the buying company’s balance sheet as a noncurrent asset.

Have anything else you’d like to add? Let us know in the comments section below!